The metaverse has been described as the next phase of the internet: interconnected and persistent 3D spaces where we will work, play, and, so it seems, purchase virtual real estate. But metaverse-related technologies have failed to keep up with the considerable hype, the vision of ultrarealistic virtual environments offered by tech vendors miles away from the current reality of cartoony avatars and cumbersome, expensive headsets.

As the hype spotlight has shifted sharply to generative AI and all its dangers and possibilities, talk of the metaverse — or “Meh-taverse” — these days largely centers on its demise. And not without reason: Meta (formerly Facebook), which changed its name in 2021 to reflect its new focus, has spent billions on VR development with comparatively little return, at least so far. Sales of VR and AR headsets have fallen short of expectations. And Microsoft shuttered AltspaceVR, the social VR platform it acquired in 2017, and has reportedly laid off workers focused on mixed reality development while making AI its clear priority going forward.

The metaverse’s association with other struggling “Web3” technologies, namely blockchain, NFTs, and crypto — considered by some to be essential to the future decentralized metaverse — hasn’t exactly helped either.

“We are in a winter for the metaverse, and how long that chill lasts remains to be seen,” said J.P. Gownder, vice president and principal analyst on Forrester's Future of Work team. Late last year, the analyst firm predicted a drop-off in interest during 2023 as a more realistic picture of the technology’s current possibilities emerged. “The hype was way exceeding the reality of the capabilities of the technology, the interest from customers — both business and consumer — and just the overall maturity of the market.”

Yet the metaverse concept isn’t going away. “We think that, in the future, something like the metaverse will exist, whereby we have a 3D experience layer over the internet,” said Gownder. Don’t expect this to happen any time soon, though: the development of the metaverse could take a decade, according to Forrester. Another analyst firm, Gartner, envisions a similar timeframe.

Gartner

Gartner

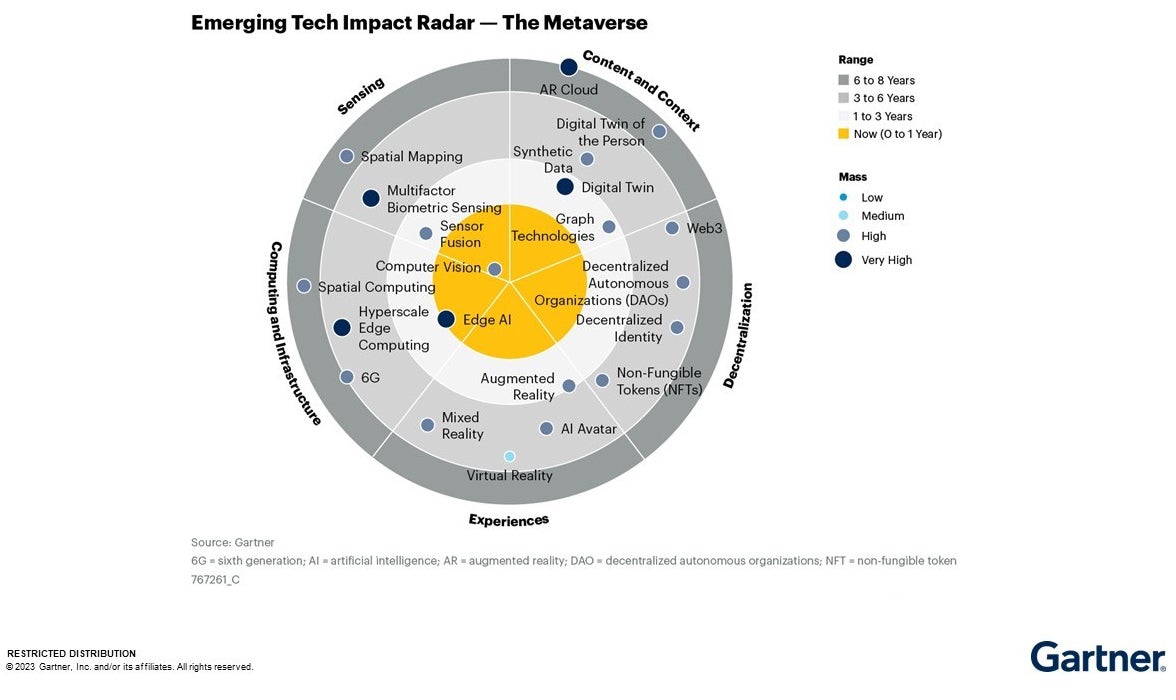

Research firm Gartner is tracking multiple metaverse-related technologies. (Click image to enlarge it.)

As metaverse hype subsides, the underlying technologies continue to develop and evolve, on both the hardware and software front. At the same time, necessary but less attention-grabbing elements, such as standards, are beginning to coalesce, with the establishment of the Metaverse Standards Forum, for example. Meanwhile, businesses continue to find a variety of use cases — whether in virtual and augmented reality or browser-based 3D environments — for what may prove to be the precursors to a more fully formed metaverse further down the line.

“We need to think about this notion of the ‘Meta’ metaverse and put that aside for now,” said Ari Lightman, professor of digital media and marketing at Carnegie Mellon University (CMU). Instead, attention could shift to the development of “smaller metaverses” as the nascent underlying technologies continue to mature, albeit at a slower pace.

“There continues to be steady development of metaverse-type concepts. But just like we saw with the march to autonomous vehicles, this takes a long time to mature and put into place,” Lightman said.

Early test grounds: ecommerce and marketing in the ‘metaverse’

Financial services firm BlackRock believes the metaverse will take years to come to fruition but sees potential now for investments in companies that build the underlying technologies. Earlier this year, BlackRock established an exchange-traded fund (ETF) that focuses on a wide range of tech companies seen as connected to the metaverse concept, from Apple and Microsoft to chip makers Nvidia and Qualcomm, 3D simulation software firm Dassault Systèmes, and games companies including Activision Blizzard and Ubisoft.

“The metaverse is in an early adoption stage, with massive disruptive potential across media and entertainment, communications, healthcare, and even education and enterprise tools,” said Jeff Spiegel, head of US iShares Megatrend and International ETFs at BlackRock. Spiegel pointed to a McKinsey report that claims more than $120 billion was invested in building metaverse-related technologies during 2022, more than double the previous year. “We believe this is just scratching the surface of theme’s total addressable market,” said Spiegel.

It’s not clear how investment levels are holding up this year, given the shift in mood toward the near-term potential of the technology. It certainly seems as though the rate of metaverse-related announcements by large brands has tapered off during 2023.

But the recent backlash against the metaverse concept hasn’t halted business interest, according to one survey, at least. Two-thirds of global business leaders say the metaverse will have a “significant impact” on global business in the next 10 years, according to a survey of 250 board members, executives, and business leaders conducted by consultancy firm Protiviti and the University of Oxford between December 2022 and February this year.

Almost half (45%) have already begun to use the metaverse to engage with customers, and a further 20% plan to start doing so in the next two to three years. Marketing and advertising is the most common use case (79%), followed by immersive shopping and product simulations (43%).

Games such as Roblox, Fortnite, and Minecraft Marketplace have been viewed as one way for businesses to engage in an early form of the metaverse, as well as blockchain-based digital worlds such as Decentraland and Sandbox, which have a strong focus on commerce. Nike, Lego, Walmart, H&M, Coca-Cola, and Burberry are among the brands that have established a presence in these types of shared 3D worlds in recent years.

Burberry

Burberry

‘Burberry: Freedom to Go Beyond’ is an adventure game within the world of Minecraft.

“A lot of the brands we work with, whether it’s Nike or Estee Lauder, have been thinking about utilizing this space as a mechanism to connect with the next generation of consumer — Gen Z and the like — and also to understand what is the blend between physical and digital [for retail experiences],” said CMU’s Lightman.

Immersive 3D platforms are nothing particularly new: Linden Lab launched its 3D social platform Second Life in 2003. Roblox officially launched just three years later, but has seen its popularity boom only relatively recently, with more than 60 million daily users, according to Statista. These 3D worlds might not be considered true “metaverse” examples in their current form, but they provide a lucrative opportunity for businesses to reach customers in immersive worlds, particularly a younger generation.

“On the consumer side… it’s a new means of marketing,” said Lewis Ward, a VR/AR market analyst at IDC. “Rather than traditional media advertising channels, you’re going to reach reasonably tech-savvy people with your message through a smartphone, laptop, or games console. I think it’s clear that has a very bright future.”

Selling to gamers populating these environments can be highly profitable. Clothes retailer Forever 21 sold more than a million units of a virtual beanie hat when it went on sale on Roblox at the end of last year. Each beanie was sold for 75 British pence (about 93 US cents), according to the Financial Times. The cost to design and launch the product: $500. The company now also sells a real-life version of the hat for $15 so that customers can look like their avatars.

Not all companies have been so successful in their early endeavors in this space. Walmart, for example, shut down one of its Roblox initiatives several months after launch, amid reported criticisms over advertising to young children.

Brands are also trying out augmented reality as a sales tool. For instance, jewelry retailer Cartier’s in-store use of AR involves customers trying on different rings more easily, Wired reported, and provides virtual access to high-end products that aren’t available on-premises. And Gucci and Ikea are among the sellers offering AR apps to let customers try out products remotely.

The metaverse at work

Outside of gaming and consumer social platforms, there are ongoing attempts to bring virtual and mixed reality to workplace collaboration, which has been tagged as another metaverse use case by some.

It remains to be seen whether employees are willing to work and attend meetings that involve wearing a headset. A 2022 survey of over 10,000 workers by Forrester showed that less than one in ten (8%) use a VR headset for work purposes each week.

Currently, at least, the technology is limited by hardware that’s often too heavy and cumbersome for extended use, while the cost of more powerful devices is prohibitive for many businesses that don’t have a serious interest in the possibilities for collaboration.

There’s certainly potential, though. Intriguing, if slightly niche, VR and AR use cases continue to emerge. In February, a Colombian court conducted a session in a virtual environment, with participants, including the judge, donning VR headsets and appearing as avatars. The two-hour hearing — a case brought by a transport union against the police — was hosted in Meta’s Horizon Workrooms, while also live-streamed on YouTube for the public to view, according to Reuters. Last month, two Scottish courts announced a plan to offer victims and witnesses access to 3D recreations of courtrooms via VR headsets in order to familiarize themselves with the environment before taking the stand and prepare for the daunting experience of giving evidence.

More broadly, it remains early days for immersive technologies in the workplace. Meta’s Horizon Workrooms is still in beta but showcases the potential of mixed reality in a work environment, particularly when paired with the extensive face and hand tracking of the Quest Pro headset, which enables a sense of presence not possible with Zoom meetings.

Meta

Meta

Horizon Workrooms from Meta showcases the potential of VR in a work environment.

Microsoft has maintained its commitment to developing metaverse-related technologies aimed at the workplace, though this has clearly fallen down the company’s priority list. The speed of development of products first announced two years ago pales in comparison to the rapid deployment of its Copilot 365 generative AI assistant across its suite of productivity and collaboration apps. Microsoft did provide an update on plans at its Build conference in May, with the Mesh developer platform and Mesh immersive spaces for Teams available in a private preview.

One feature that is now widely available is 3D avatars for Microsoft Teams meetings. It’s a small step toward a 3D immersive environment, but one that, if successful, could help normalize the use of avatars in a widely used collaboration platform, said Gownder — though he added that Teams users may simply ignore the feature.

Microsoft has also partnered with Meta to bring its Microsoft 365 apps to Quest Pro headsets, as well as provide access to Teams meetings from Meta’s Horizon Workrooms.

“We are getting to the point where people will be slowly introduced to this,” said Gownder. This could lead to a kind of reverse “consumerization of IT,” whereby workers interact with the technology first in the workplace. “Maybe I use it at work and I think, ‘Well, that's kind of cool.’ That happened a little bit with videoconferencing, especially during the pandemic,” he said.

For now, though, the use of VR for workplace collaboration remains in its infancy, said Gownder. He described available technology as “metaverse precursors,” rather than, for instance, a viable substitute for business travel for workers — one potential reason for use in the workplace. “Some of that is [due to] the experience and some of it is people themselves just not being ready for it,” he said.

In the short term, it’s likely VR/AR will play a limited role in workplace collaboration, at least until strides forward are taken in terms of usability. “It’s a long runway,” Gownder said. “I think it’ll grow, but it’s unclear that it’s going to become this really standard [workplace tool]. While it has a large addressable market in theory, we simply have not seen the proof that it will take over the way we work.”

Microsoft

Microsoft

Microsoft’s Mesh immersive spaces feature for Teams is now available in private preview.

The most tangible enterprise VR and AR uses cases center on remote assistance, where augmented reality can connect remote experts to frontline workers, for instance, and around employee training and learning, said Gownder. “The only really mature things going on in the broader extended reality space are training and learning, mostly in VR, which can be ‘metaversified’ if you allow multiple parties to participate in a virtual world,” said Gownder. “There are real companies doing it, there’s real ROI: that’s something we think we will see more of.”

The Oxford/Protiviti survey provides a similar conclusion. Almost three quarters (73%) of business leaders surveyed believe metaverse technologies will impact employee engagement in the next decade, with immersive training and learning most widely cited (54%), followed by collaboration (45%), recruitment (41%), and internal company events (35%).

VR training in its current form tends towards individual rather than group training, and so falls short of most definitions of a real metaverse technology, said Gownder: “A lot of it is not ‘metaverse,’ it's more like, ‘Here’s a VR thing. Here’s an AR thing. Here’s how it’s being used.’ You would need to add more people, more complexity, more 3D to bring it closer to the metaverse.”

Digital twins and the industrial metaverse

Another area where businesses are investing in metaverse-related technologies for the workplace is the creation of digital twins. Digital twins are dynamic, virtual recreations of physical objects and systems, anything from a factory to an airport, or even a whole city.

Digital twins don’t simply map “what is,” but allow operators to run scenario testing that is much quicker and cheaper than real-world processes. To enable this, digital twins incorporate historical data and real-time sensor data, and can use machine learning for predictive analytics. “If you’re shipping things around in the real world, or you’re optimizing a factory or other type of location... then those sorts of simulations will be valuable to enterprises because it will save them time and money,” said IDC’s Ward.

While current digital twins fall short of a fully realized vision of the metaverse, the 3D recreations of physical objects could be considered another metaverse precursor. It’s an area that has already generated significant interest. The market for digital twin services is worth several billions of dollars a year currently, according to several estimates, with huge growth forecast by the end of the decade.

Many large businesses are pursuing projects in this space. Earlier this year, Mercedes Benz announced it is using Nvidia’s Omniverse suite of 3D tools — marketed as a “platform for creating and operating metaverse applications” — to build 3D replicas of factory equipment in order to plan and optimize processes via simulation. Many other industrial and manufacturing firms have invested in digital twin systems: Computerworld’s sister site CIO has case studies highlighting a wide variety of digital twin projects at the likes of aircraft engine manufacturer Rolls-Royce, confectionary maker Mars, F1 racing team McLaren Group, and smart building firm Johnson Controls.

Nvidia

Nvidia

Mercedes-Benz will use the Nvidia Omniverse platform to design manufacturing and assembly facilities.

The technology underpinning these simulations is continuing to evolve too. Unreal and Unity, makers of video game graphics software, play an important role in the creation of graphic visualizations of 3D environments for digital twins. Both now target business customers across a variety of industrial verticals that want to create 3D objects on environments. Unity recently added its Industry product to support its digital twin business, promising a way to “build and deploy interactive real-time experiences.”

These are just some of the companies involved in taking the internet from 2D to 3D “at scale without crushing, massive bandwidth,” Ward said. Adobe is another firm focusing more on 3D toolsets following its acquisition of Allegorithmic four years ago. “There are many others that see a wave coming, with environments that go way beyond gaming, that are 3D, real-time, and on the internet,” he said. “They're prepping for expected growth there.”

The Apple factor

Part of the skepticism around the idea of the metaverse relates to lackluster sales of VR and AR headsets. Although these devices are generally not considered essential to access metaverse environments, the immersive nature of the technologies lends itself to use in this way.

IDC recently lowered its forecast for global sales of AR/VR headsets in 2023, which are now expected to reach 10.1 million units. This follows a decline in sales last year, falling 21% year over year in 2022 to 8.8 million units. The outlook is expected to improve, with shipments expected to increase 14% this year, though the number of devices sold pales in comparison to other computing device segments.

“The hockey stick [growth] that we projected years ago… by and large, that curve has come down over time. So the reality has underwhelmed in terms of actual adoption,” said Ward.

Some believe the widely expected launch of Apple’s VR headset next week may lead to more mainstream adoption of mixed reality further down the line. “The fact that Apple is going to put its weight behind [VR] will cause a lot more companies to think about what they can do with it,” said Ward.

While it’s unlikely that Apple will bill the headset primarily as a business device, there are clear applications for workplace use, such as with its Freeform collaborative whiteboard app. “Apple won’t necessarily market to them directly, but they will inevitably end up as enterprise tools,” said Gownder.

Apple has been the catalyst for mass adoption of other devices, and its headset is expected to be significantly more powerful than other mixed reality devices, rumored to rely on the company’s own M2 chips used in its laptops and desktops.

In a note to clients last week cited by MarketWatch, Bank of America Securities analyst Wamsi Mohan commented: “Although the lackluster uptake of the AR/VR (augmented reality/virtual reality) market and the transitory enthusiasm about the metaverse create a backdrop of challenges, it is instructive to remember that Apple invents entire new categories that have the potential to disrupt existing markets (e.g., AirPods) and create entirely new markets.”

Lightman agrees. “Apple’s very good at understanding the social structure around technology and computing. They’re known for innovation and for design and human assessment, understanding the human factor,” he said.

Of course, it remains to be seen how the expected Apple headset will fare: a recent Bloomberg report suggested ambivalence within the company about the release of the device. It’s thought that Apple’s headset will be pitched as a developer tool with a high price tag to match, and therefore unlikely to spark sales like the iPhone, iPad, or Apple Watch did.

Whether Apple can serve as the catalyst for VR adoption and shift public opinion on interactions in immersive worlds is an open question, Lightman said. “It wasn’t Meta... but if Apple comes up with a headset [that is well-received], will that be the flashpoint that spurs on everybody in the space?”

However long it takes, Ward is confident that the metaverse will eventually catch on. “The idea of the 3D internet... I don’t think there’s a chance that that’s going to die. You’re going to be able to experience that on every device out there: smartphones, PCs, tablets, TV sets, and, yes, AR/VR headsets.”