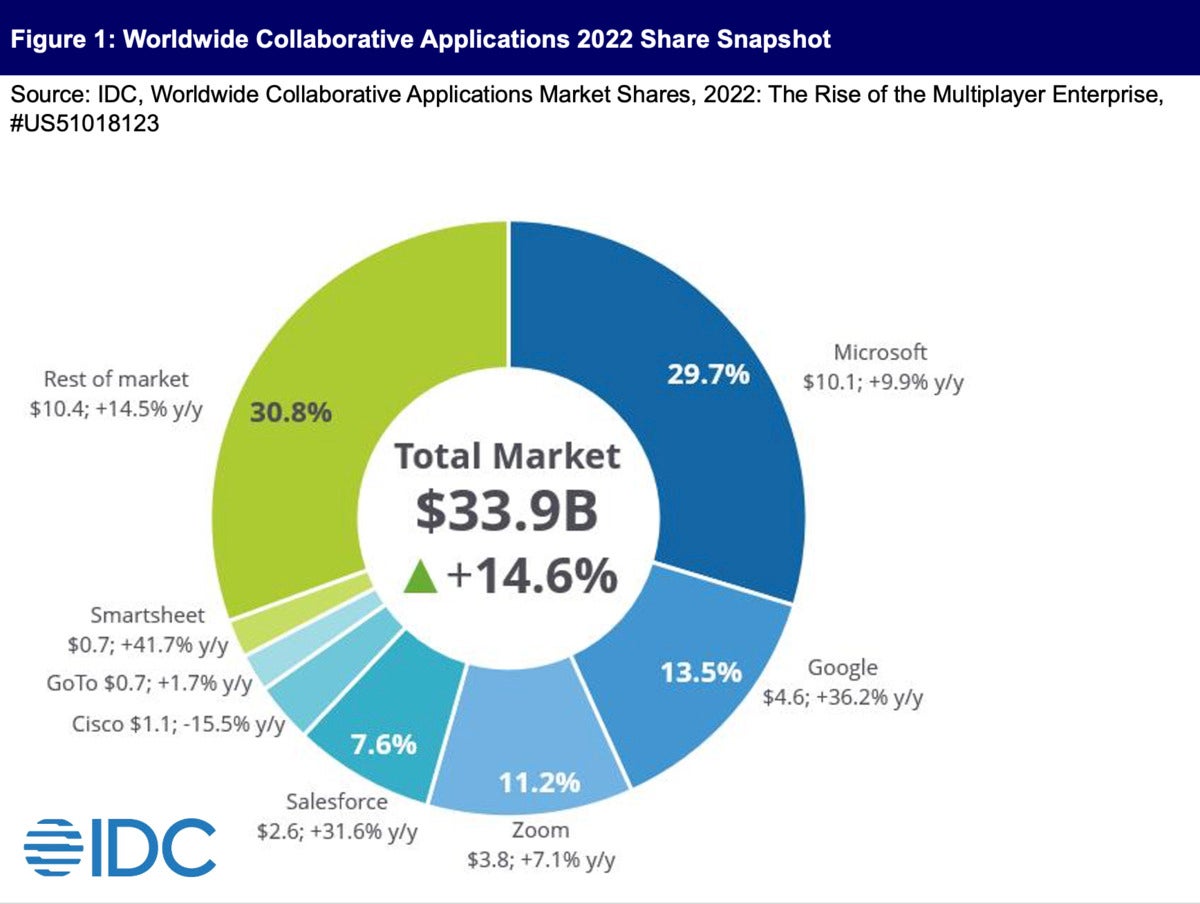

Global business spending on collaboration software — including videoconferencing apps, team chat, email, and more — reached $33.9 billion in 2022, according to a recent IDC report. It was the seventh consecutive year of double-digit growth, up 14.6% compared to the 2021.

But that figure amounted to slower year-on-year growth compared to IDC data from the preceding two years (28.4% YoY growth in 2021, and 32.9% in 2020 at the height of the COVID-19 pandemic and the rapid shift to hybrid and remote work).

Microsoft accounted for the largest portion of the collaboration applications market last year (29.7%), according to IDC, followed by Google (13.5%), Zoom (11.2%), Salesforce (7.6%), and Cisco (3.2%).

IDC

IDC

Worldwide collaborative applications market share in 2022.

The growth in spending during 2022 was driven partly by organizations rolling out collaboration applications to a wider set of workers. “[Businesses] are still connecting more of their workforce, be it frontline workers or contract workers, and that's adding users,” said Wayne Kurtzman, IDC's research vice president for collaboration and communities. "There’s also increased investment in applications such as enterprise community platforms and visual collaboration platforms."

What’s held back spending growth rates in recent months, he said, has been downward pressure on average revenue per user (ARPU), as vendors offer integrated and bundled collaboration options that provide access to a range of features at a lower price compared to apps purchased individually. This has affected videoconferencing applications in particular as adoption of these tools matures.

Looking forward, IDC expects business spending on collaborative applications to more than double in the next five years to a total of $71.6 billion by 2027, according to another recent report.

The anticipated growth will likely be boosted by the inclusion of generative AI features within collaboration software products. Google, Microsoft, Slack and Zoom are just some of the vendors now developing AI features for their software. Those genAI tools include automated meeting summaries and email message draft generation, which vendors have promised will save workers time on certain tasks.

Microsoft and Google have both said their genAI features will cost $30 per user each month for large business customers, though it’s likely that those on lower tier pricing plans won’t pay as much.

“In the future there will be features — AI, for example — that will be additive to the price,” said Kurtzman. "You'll see the ARPU increase later in the five-year period, because of some of these additions. You could see it a little bit more next year, 2024, with some of [the recent ARPU decreases] starting to reverse."

![A glowing blue arrow speeds ahead of a pack of black arrows [lead / compete / momentum / growth]](https://images.idgesg.net/images/article/2020/09/one_glowing_blue_arrow_speeds_ahead_of_a_pack_of_black_arrows_leadership_competition_momentum_growth_by_gremlin_gettyimages-1050942106_2400x1600-100858617-large.jpg?auto=webp&quality=85,70)