The scope of workplace collaboration tools available to teams today stretches far beyond anything employees might have imagined two and a half years ago. When work-from-home orders swept the globe in early 2020, most organizations were focused on ensuring they had viable video and chat platforms in place. Now, as a significant proportion of employees have decided to work outside of the office for at least part of the work week, tools that do more than just support workers’ basic communication needs are becoming more sought after.

One product that has seen an explosion in growth this year has been the digital whiteboard. Also known as visual collaboration platforms or shared canvas apps, these tools let hybrid teams collaborate visually via an online interface.

Between March and May 2022, Box, ClickUp, Mural, BlueJeans, and Zoom all made announcements relating to the launch of a new whiteboarding product or significant updates to an existing whiteboarding tool. Why the flurry of activity?

Connecting a hybrid workforce

Data published by Forrester in May 2022 shows that 62% of business and technology professionals who have transitioned at least some of their workforce to full-time remote work due to the COVID-19 pandemic anticipate that they’ll maintain a permanently higher rate of full-time remote employees, even across traditionally in-person industries. As a result of these wide-reaching changes to the workforce, many organizations are searching for ways to create a more unified collaboration experience for a geographically dispersed workforce.

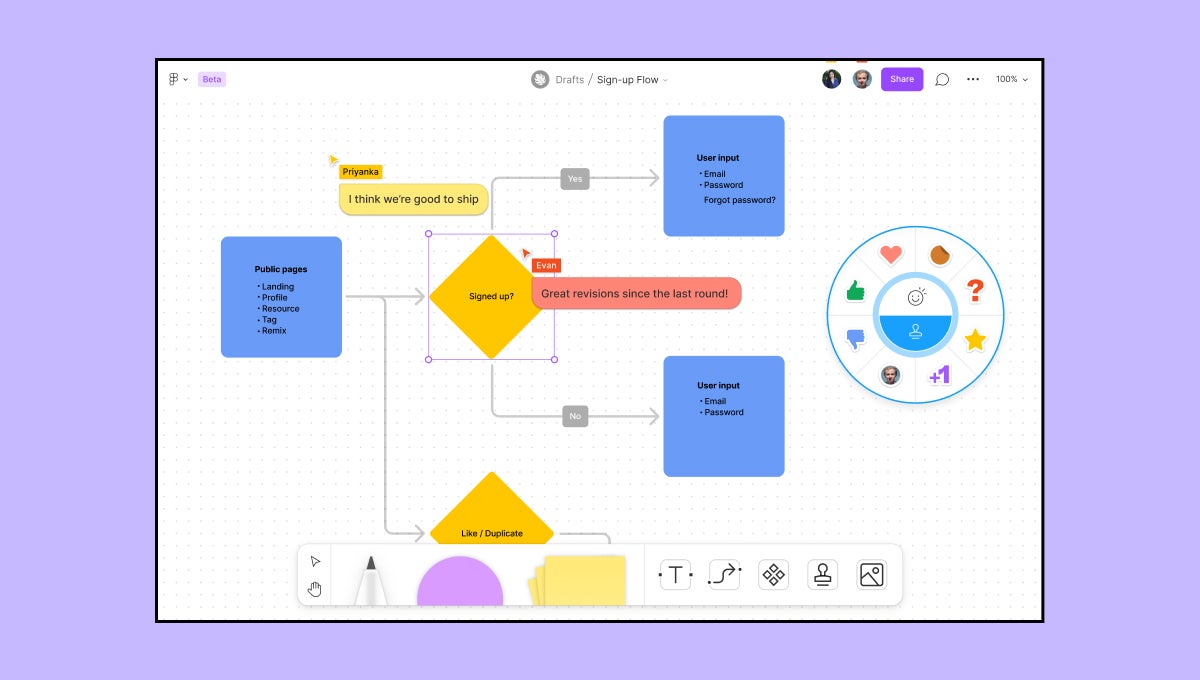

Digital whiteboard vendors say their platforms fulfill that need. Typically accessed via web browser, visual collaboration apps create persistent workspaces where team members can collaborate from any device, in real time or asynchronously. In addition to drawing and writing tools, the apps offer users the ability to add images, videos, diagrams, sticky notes, and other elements. Several platforms offer integrations with enterprise tools such as Slack, Trello, Jira, Dropbox, Google Drive, and Microsoft Teams.

Andrew Hewitt, a senior analyst at Forrester, said that virtual whiteboards provide a way for organizations to reduce the friction between hybrid and remote workers. But, he noted, because very few people considered a physical whiteboard key to their work setup before the pandemic, workers who had no need for an online brainstorming tool three years ago are unlikely to be pushing for their adoption today.

Historically, the customer base for digital whiteboard tools is made up of developers or those working in creative roles like design, not general business users. So, unlike more traditional collaboration tools such as videoconferencing and chat platforms, which have an enterprise adoption rate of almost 80%, digital whiteboarding tools have yet to become widespread in the corporate world.

“Just like with any technology, getting people to deploy these tools and learn how to use them effectively is really important for their overall adoption — especially in this market where you’re asking people to collaborate in a way they might not be accustomed to,” Hewitt said.

Whiteboarding tools are not just for “work” work

In November 2021, Research Nester estimated that the visual collaboration market is set to be worth $1.67 billion by 2028. One company operating in that space is Figma, which offers a collaborative browser-based interface design tool. The vendor’s FigJam whiteboarding solution was launched in April 2021 and now counts Stripe, Twitter, Airbnb, and Netflix as customers. Adobe has just announced a $20 billion deal to acquire Figma.

Emily Lin, product manager at Figma, said that even before 2020, the company was seeing a trend among Figma customers who were using the tool to make the design process more collaborative. Engineers and project managers who were not traditional Figma users were starting to use the tool to collaborate with design teams in a way the company had never seen before.

“We saw that people were beginning to push the platform beyond things like classic UI design and instead beginning to use Figma for things like ideating on what they should even design,” Lin said.

As a result, the company decided to launch a dedicated tool that would allow all these different teams to come together in one place and collaborate. When FigJam first hit the market, Lin said it had two key use cases, one being ideation and brainstorming and the second being user flows and basic diagrams.

However, after the launch of FigJam, the company saw a spike in customers using the platform as a means of socializing with teams. Users started sharing their unique FigJam use cases on Twitter and developing team rituals such as a Friday coffee chat or a games night.

Now the platform offers more playful capabilities, including a photobooth that takes digital polaroid pictures of whiteboarding session participants, alongside the traditional options.

External developers who use FigJam in a professional capacity have also extended the platform’s socializing capabilities. Lin said the company is seeing a lot of individual developers as well as partner companies build add-ons that have pushed that end goal of helping teams feel more connected and engaged.

“Someone created a widget that had different icebreakers and games that you can play with people, and there’s even things like Rock Paper Scissors. There are now all sorts of activities which are really fun and sit alongside your traditional JIRA and Asana widgets,” she said.

Although Figma is platform designed specifically for designers, Lin said that 70% of FigJam’s new users are people from other parts of the company.

Financial services and software company Stripe is one of FigJam’s customers. Although the company declined to name the tools it was using before FigJam came onto the scene, Talia Siegel, product designer at Stripe, said the other tools didn’t offer templates that made it easy to brainstorm or work alongside many colleagues at a time.

Like most customers, Stripe originally started using the platform for team brainstorms, but over time have embraced what she describes as the “playful side” of FigJam. “Illustrations, stickers, and emojis fill our brainstorming docs now. We also have used FigJam to create activities for team-wide bonding while working remotely,” she said.

What’s the future of the whiteboarding market?

Despite the spate of product launches at the start of the year, Hewitt said the market is still relatively undersaturated. But, as the popularity of these tools continues to grow, we’ll likely see more vendors enter the space — in mid-August, for example, graphic design platform Canva became the latest company to launch a whiteboarding product.

“[For vendors] there's always this question of: ‘Do I build it natively? Do I integrate or do I acquire something?’” Hewitt said. “There’s also a lot of small vendors that would be ripe for acquisition in this space... but currently, there are only around six vendors total that are really making strides.”

And where FigJam has seen its use cases expand beyond its original purpose, Hewitt said that a lot of vendors in this space don’t want to be seen as just a whiteboarding solution, instead focusing on the wider visual collaboration aspect of this technology that enables multiple types of collaboration, such as content creation, project management, mind mapping, and design sprints, among others.

As the market continues to grow, Hewitt said we can expect to see these platforms integrate with other technologies including AR, VR, and the metaverse. “It’s very, very early days for that right now… but that is definitely something people are hypothesizing, that the market will move in that direction, and we’ll see better integration between AR and VR technologies and the visual collaboration tools themselves.”

However, he warns that while employees might have started to see the benefits of having access to a visual collaboration tool, standalone platforms might find themselves struggling to grow their customer base in a tough economic climate. If companies are forced to make difficult budgeting decisions, a one-off visual collaboration platform might fail to justify itself economically, compared to a simpler whiteboard tool included in the licensing cost of a larger unified communication platform that addresses a company’s overall collaboration strategy.

“[Whiteboarding tools are] an add-on capability, but it’s not the case that if you don’t have this product, you’re going fail as an organization,” Hewitt said.