Core business centers in large and small cities throughout the US are suffering the effects of hybrid- and remote-work policies, which has led to a 20% to 40% reduction in office space use, according to global management consulting firm McKinsey & Company.

The switch to primarily remote work at the start of the COVID pandemic in March 2020 left downtowns largely empty. Since then, commercial areas have seen a slow, but steady, return to the office, with average office occupancy hitting 50% of pre-pandemic levels this past March, according to commercial real estate services firm CBRE Group.

But that's enough to offset sizeable drops in the value of office space, and the need to re-think what an "office" now is. In San Francisco, for example, an office building worth $300 million before the pandemic could now be worth just $60 million, an 80% loss in value. Nearly 30% of downtown office space is vacant, according to CBRE.

New York City saw a 45% decline in office values in 2020, and over the next two years those values declined 39%, representing a $453 billion loss in overall office real estate value, according to a September study by the National Bureau of Economic Research.

And even in smaller, less-dense commercial areas, the problem persists. In Durham, NC, the headquarters of health information technology firm IQVIA lies empty, a victim of hybrid and remote work policies. The IQVIA building rests in the Research Triangle created by Raleigh, Durham and the town of Chapel Hill, NC. The Triangle currently has 4.4 million square feet of vacant office space, or a record high 8.3% of overall market inventory.

With the shift to hybrid and remote work expected to stay, the future of the traditional downtown office — and what that means for workers — is decidedly hazy.

“We have seen broad-based adoption of hybrid work throughout the pandemic, and we expect to see persistence going forward,” said Ryan Luby, an associate partner at the McKinsey Global Institute think tank. “We don’t see this as the kind of thing that gets clawed back in the context of a loosening of the labor market if a recession hits.”

Some reports have blamed the office vacancies on high-profile layoffs during the past year, especially among technology companies. However, the labor market remains tight.

The COVID pandemic served as an unintentional experiment that revealed a host of uncomfortable truths, namely that employees always preferred remote work and at-home knowledge workers were just as, if not more, productive. Another realization: working in the office, by default, was less great for some people than others, according to Phil Kirschner, an associate partner in McKinsey & Co.’s real estate and people and organizational performance practices..

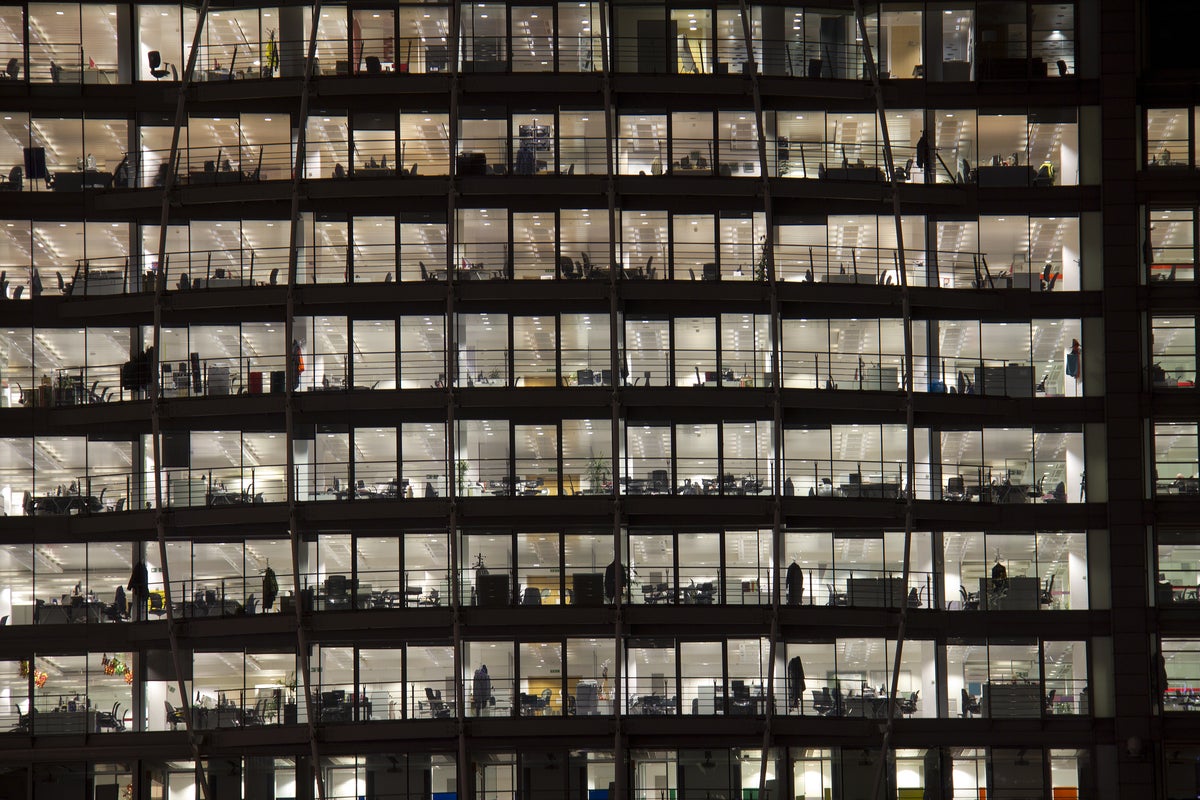

Shutterstock

ShutterstockNot everyone, for example, had the same level of inclusion and equality in an office setting; that allowed working from home to become a great equalizer.

“Diverse populations of almost any measure — whether skin color, sexual orientation, physical disability — are affected by in-office requirements, and there’s a higher desire for workplace flexibility either when taking a job or the likelihood to leave a job if you’re not offered it,” Kirschner said.

“So, anyone who wants to combat an empty office with a mandate is running a very real risk of telling certain populations [something] they don’t want to hear. And these are populations you don’t want to upset,” he added.

Google

Google

One of Google's "campfire" room layouts that enable a more interactive remote meeting because monitors are placed where eveyone has the same view and it is at eye level.

Micah Remley, CEO of workplace management software maker Robin Powered, said companies face a communication quandry they must address. “Some companies are forcing employees back to the office, even going so far as threatening pay cuts. This is not the way to do it,” he said. “Employers are going to need to be clear on what hybrid work means in their organization — and they’ll need employees to buy into that.

"You can’t flip a switch and go from a fully remote culture to the expectation that workers are going to be in five days a week. It creates a combustible culture.”

Widespread adoption of hybrid work created a structural shift in the office market, reducing demand for space and propelling the overall vacancy rate to a 30-year high of 17.3% in the last three months of 2022, according to an April report by CBRE titled “Hardest Hit Office Buildings Share Common Characteristics.”

CBRE’s findings were echoed by Kastle Systems, a provider of fob security key technology for 2,600 buildings in 47 states. Average daily office attendance has hovered around 50% of pre-Covid rates since the beginning of 2023, according to Kastle Systems.

“With many employers setting new hybrid policies, that daily rate fluctuates with Tuesdays and Wednesdays having attendance well above the average rate and Fridays falling well below,” Kastle CMO Jake Heinz wrote in an email reply to Computerworld. “The overall weekly average shows office occupancy attendance rates have pretty steadily increased over the last year, rather than decreased and that behavior holds true across the metro markets we serve.”

Strikingly, just 10% of US office buildings account for 80% of the vacancy created since 2020 — and account for only 17% of total office square footage, according to CBRE. (It calls those structures the hardest hit buildings (HHBs).)

Downtown buildings had a far higher percentage of HHBs (41%) compared to office buildings nationally (29%). One in every seven downtown office building qualified as an HHB, compared to one in 12 suburban buildings, according to CBRE. The Northeast and Pacific coastal markets had a higher percentage of HHBs and a slower return to office rate than Southwest and Midwest markets.

Building age was not a significant factor in hard-hit areas, according to CBRE, but crime rates are. The buildings with high vacancy rates were in downtowns with high crime and often in areas lacking restaurants and retail stores.

Even with more companies pushing workers to return to the office, the first quarter of this year saw 16.5 million sq. ft. of negative net absorption -- the weakest quarter for office demand in two years -- due to recession fears and hybrid work arrangements, according to CBRE.

(Negative net absorption refers to more commercial space being vacated and placed on the market than leased. It indicates net demand for commercial space has decreased in the space market relative to supply.)

Even pre-pandemic, office space was overprovisioned and underutilized, according to Kirschner. Studies by Kirschner and the Institute showed as much as 30% to 40% of office space went unused because companies leased more than what they needed, hoping they’d grow into it or misjudging just how many employees actually came into the office. “Any study that anyone like me ran of a company of any size usually surprised the boss with just how empty the office was on a daily basis,” Kirschner said.

Some building owners simply 'handing the keys back to banks'

CBRE estimates that if nothing is done to remove, revive or repurpose existing buildings hit by the hybrid work trend, the long-term US structural vacancy rate would rise from 12% now to 14.5%, “creating an additional 103 million sq. ft. of vacant space,” a CBRE blog said.

The most modern office buildings were somewhat buffered against the vacancy trend due to a flight to quality, but the impact on the devaluation of lower quality office space will have repercussions for building owners, banks, the leasing tenant, and even taxpayers if government bailouts are needed.

Shutterstock

Shutterstock“In a situation where everything falls to the owner, and that’s happened with Blackstone and a couple of others, they’ve just handed the building keys over to the banks and said ‘It’s worth 30% less. I’m not going to be able to fill this,’” Luby said. “Part of what’s changed over the past six months is we’ve gained clarity and conviction that flexibility and hybridity is here to stay. And it takes that conviction before you start to have knock-on effects in commercial real estate markets.

"Until you have conviction that we’re not returning to the office like we had pre-COVD, you can market to pre-pandemic valuations. Once that’s internalized from a price perspective, that’s when you start to see stress and transformation.”

In particular, Class B, Class C and even lower-end Class A grade buildings will see the biggest valuation declines in the current market; those who lease or buy now want top-notch AAA buildings, or those with the latest amenities, technologies and locations.

A flight to building brand recognition

Buildings enjoying the highest occupancy rates, according to McKinsey, are those with the best amenities – and that means more than just a good cafeteria and comfortable office spaces. Employers want buildings with the latest technology to enable a permanent hybrid work force and ease of movement and space flexibility when employees enter the office.

The bar for office space has been set much higher because it must effectively compete not only with the home, but every other place a worker can use to perform work, including coffee shops and restaurants.

“What used to be a nice office location...is not enough,” Kirschner said. “You have to take an active role in the community, the flexibility, the technology and the user experience of this building to attract the tenants who, in turn, attract the employee.”

For example, building security now takes a backseat to enabling employees to move around freely using a fob or key card and without losing Wi-Fi connectivity. And if the in-office meeting experience is worse than what an employee gets from home or the local cafe, why go into the office?

Robin Powered’s Remley agreed with Luby, saying employers are downsizing their physical footprints by removing excess furniture and investing more in technology. “Zoom’s impressive Q4 numbers are indicative of this trend,” Remley said. (Zoom’s revenue was up 66% year-over-year in Q4, 2022)

Companies are also creating comfortable breakout areas to foster collaboration rather than a slew of desks people won't use, Remley said. “This is in addition to approaches like hot desking and activity-based working (ABW), which takes hot desking a step further by creating multiple different types of workspaces geared towards different activities.”

The rise of 'Brandlords'

AAA-class office buildings also need to build “brand recognition,” according to McKinsey & Co. For example, McKinsey’s New York City headquarters are located in the World Trade Center complex.

“I take it for granted that almost anyone in the city knows that Silverstein is the developer. But I can nearly guarantee you that we could stop people in the building all day long and ask them who’s building this is, and they wouldn’t know,” Kirschner said.

Brandlords, as Kirschner calls them, create office buildings distinguished by quality and that look and feel alike regardless of location. Desirable building brands would offer not just the ability to expand and contract shared meeting and event spaces, “but a dynamic digital layer throughout the building,” Kirschner said.

If a New York tenant travels to a building in Chicago for work, they should experience the same amenities. “I want to form some type of brand loyalty with the landlord — not just if I’m an employer and I may have offices with the same landlord in three cities, but that I, as a walking occupant, recognize it as a Silverstein building and think, ‘Oh, I like this building,” Kirschner said.

Even in New York City, which now has an oversupply of office space, developers could build 10 more AAA-class, brand-name buildings and they’d fill up. “People would pay top dollar for them,” Kirschner said. “It’s the buildings on the margin that are going to be harder to sustain.”